Celebrating Community Banks, Our Partners in Progress

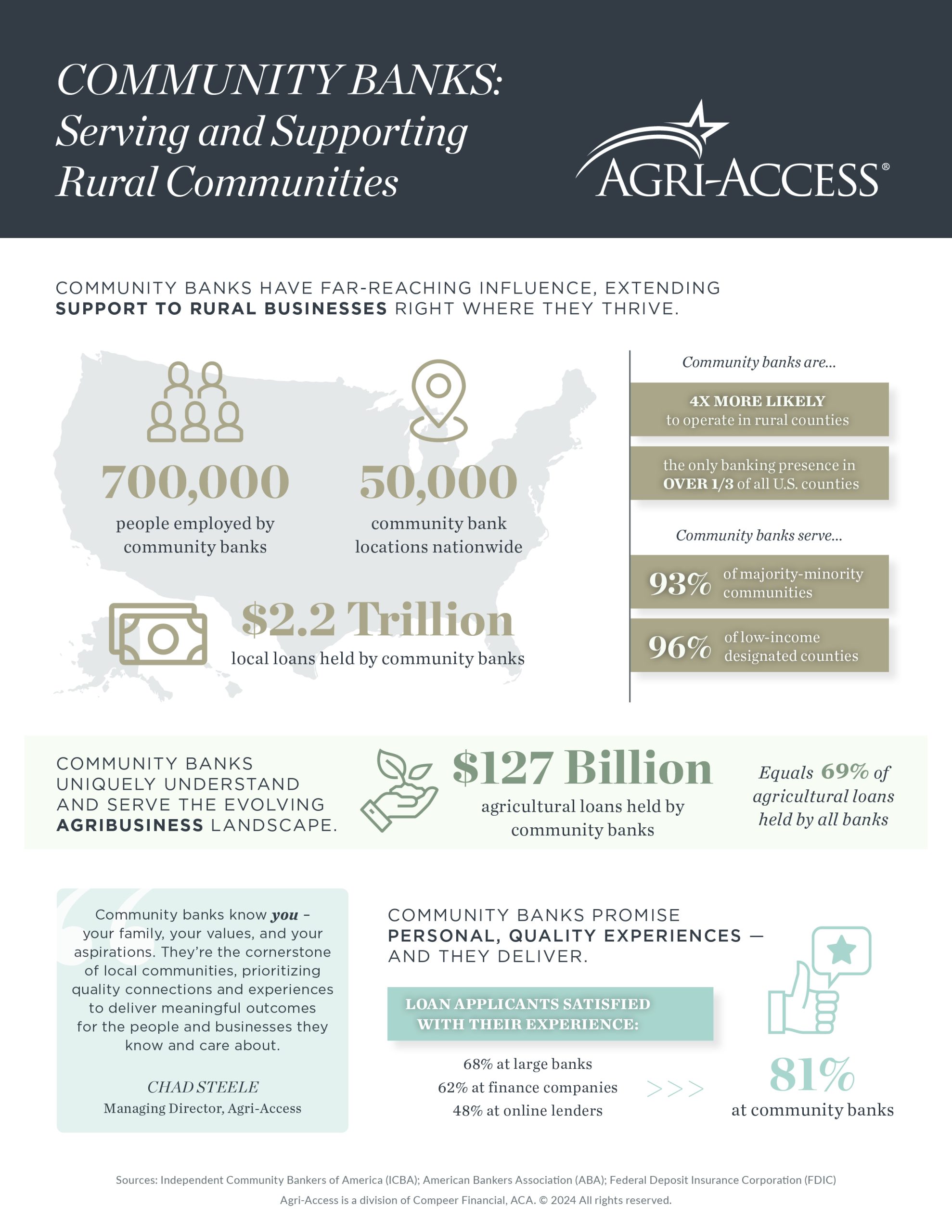

April is Community Banking Month, a dedicated time to acknowledge the value that community banks deliver to local and rural communities. The relationships they foster, the innovation they drive, and the outcomes they achieve for the people and businesses they know and care for are seen, appreciated, and celebrated by Agri-Access.

With a unique understanding of their clients’ values, aspirations, and goals, community banks play a vital role in financing in rural communities. They don’t just provide services; they facilitate achievements — and their personalized touch doesn’t go unnoticed. ICBA data reveals that 81% of loan applicants are satisfied with their community bank experience, a significantly higher rate than large banks, finance companies, and online lenders.

Community banks, particularly agriculture (ag) lenders, are not just financial institutions. They are partners in progress, expertly balancing consistent services and continuous growth. They are at the forefront of preparing their clients and communities for the new age of agriculture, ensuring they are supported and ready for the changes ahead.

Going Above and Beyond in the New Age of Ag

Digital advancements continue to sweep the ag landscape, shifting how farmers, ranchers, and growers approach their work. This transition can be challenging, with many still preferring the manual or physical products and tools they know and love.

In the face of evolving market dynamics, community banks are not bystanders. They are active guides, helping their ag clients adopt the right tools and technologies to propel their financial operations forward and providing comfort and ease as the ag landscape edges towards another evolution.

But to do so, ag lenders must also shift and strengthen their operations. They’re expected to provide online loans that offer fast answers and quick capital access while also expanding their lending ability. This is a tall order, but the most sought-after, trusted ag lenders continuously rise to the occasion with high-quality standards and trusted services.

At Agri-Access, we’re thankful to partner with rural and local lenders, helping them grow their lending portfolios, innovate on their ag products, and provide expert guidance throughout the lending process. While community banks go above and beyond to help their clients seize new opportunities, we’re there to help community banks mitigate risk, enhance their capacity, and expand their value along the way.

Learn more about partnering with Agri-Access and our seven-step loan process here.