Community Banking Month: Why Community Banks Matter More Than Ever in 2025

April is Community Banking Month, a time to celebrate the local institutions that serve as the lifeblood of rural economies.

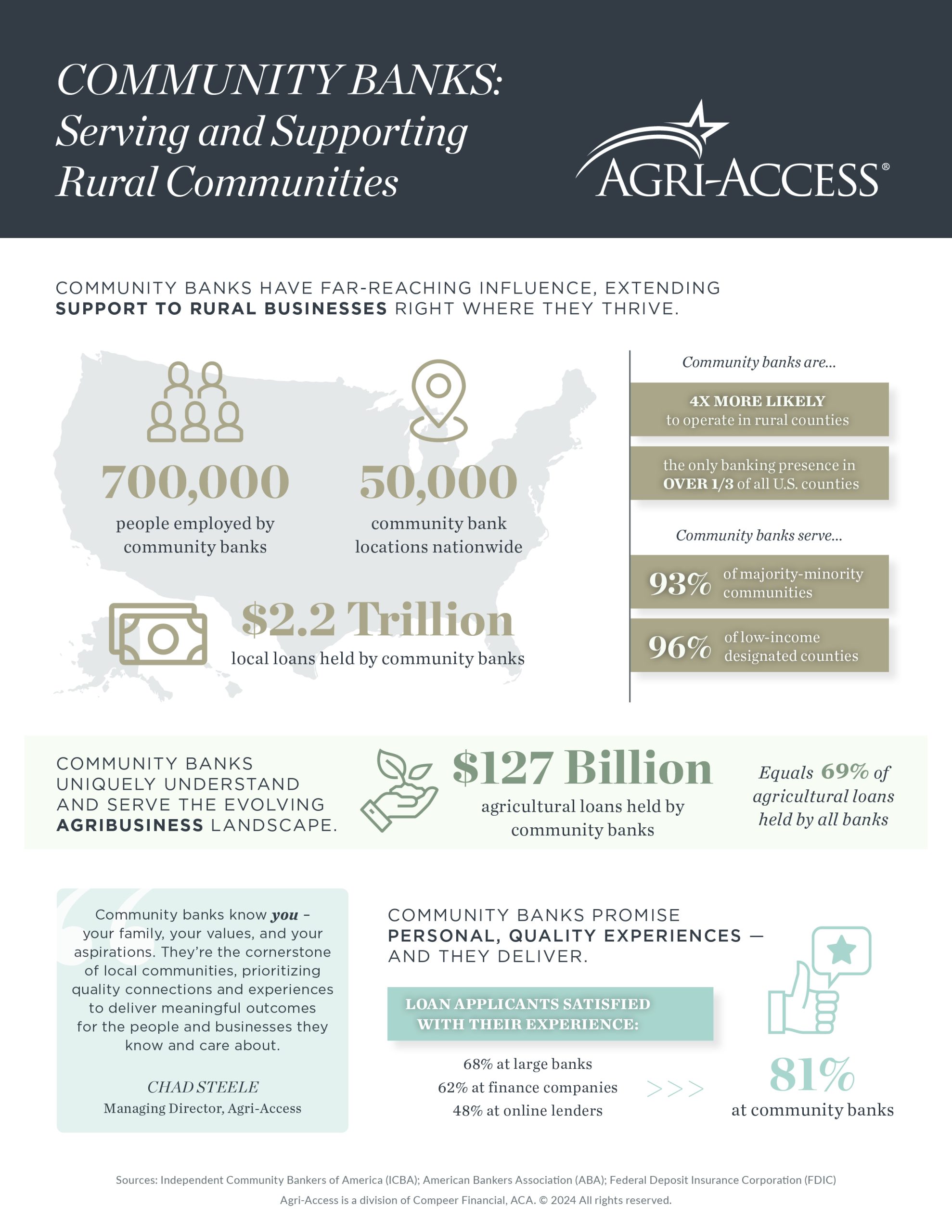

Every day, these lenders play an extraordinary role all across rural America. Community banks don’t just provide loans and financial services — they help rural economies thrive.

By taking a personal approach and truly understanding each customer’s business, community bankers look for a way forward where larger lenders see only risk. That’s why, in 2025, community banks are more important than ever.

Agri-Access: Empowering Community Banks to Do More

While community banks work hard to support their customers, they don’t do it alone.

At Agri-Access, we’re proud to be a behind-the-scenes partner, equipping lenders through secondary lending solutions that serve rural America at scale.

By partnering with Agri-Access, community banks can expand their impact and punch above their weight in ag lending. Here’s how:

-

Expanded lending capacity

Agri-Access provides secondary lending solutions that allow community banks to finance larger or more complex agricultural projects than they could on their own.

By purchasing a portion of loans or providing additional capital, we help local banks increase their lending limits and share risk — while the lender services the loan.

This means farmers and ranchers can secure the funding they need without leaving their hometown bank. Community banks can greenlight more loans, confident they have the support to manage the risk.

-

Innovative lending solutions

We help community banks modernize their ag loan offerings to meet today’s borrower expectations.

Programs like our Scorecard loans and our 7-step loan participation process allow for faster underwriting and streamlined loan decisions — helping banks provide the kind of speed and service busy farmers demand.

By augmenting local lenders’ capabilities, Agri-Access helps community banks stay competitive, even in a rapidly evolving ag finance landscape.

-

Strengthened ag lending expertise

When community banks partner with Agri-Access, they gain a team of agricultural lending specialists in their corner.

With decades of experience in ag finance, our experts provide ongoing support and guidance to our lending partners.

Need to evaluate a larger farm deal? We’re just a phone call away.

Our relationship managers work one-on-one with community bankers, providing insights on everything from farmland appraisals to lender liquidity strategies.

Having this extra expertise just a phone call aways empowers local banks to make informed decisions and serve their farm customers with confidence.

The Agri-Access advantage: Helping rural America win

At Agri-Access, our mission is yours: helping farmers and rural businesses prosper.By working together, we create a win-win-win scenario:

- The bank grows and innovates

- The farmer gets the best possible financing

- The community thrives with a stronger ag economy

Evolving and succeeding through partnership

Community banks built a legacy in rural America. As we celebrate Community Banking Month, it’s also a time to look ahead. The landscape of agriculture and banking will continue to evolve, and the most successful community banks will be those that embrace partnerships that enhance their strengths.

To keep the momentum going, we invite community bankers to deepen their strategies for the future.

Get our free Ag Lending Strategies eBook – “5 Strategies for Preserving Liquidity & Increasing Competitiveness.”

This resource is packed with insights on how to:

- Grow your agricultural loan portfolio sustainably

- Navigate liquidity pressures

- Deliver innovative financing solutions to your farm clients