Land Value Trends Revealed by 2024 Benchmark Farm Appraisals

Farmland markets in 2024 were anything but static. From Illinois to Minnesota and beyond, land values revealed a complex story of regional shifts, economic pressures and evolving buyer strategies.

Agri-Access’ appraisal team monitors 53 benchmark farmland properties across Illinois, Minnesota, Wisconsin, Iowa and Indiana. These properties are appraised monthly, providing real-time insights into market trends and shifts and underscoring the importance of staying informed.

The 2024 land value trends suggest a general softening in the farmland market. Dive into state-specific trends, key takeaways and what they mean for farmers and landowners preparing for 2025 below.

Benchmark Trendlines

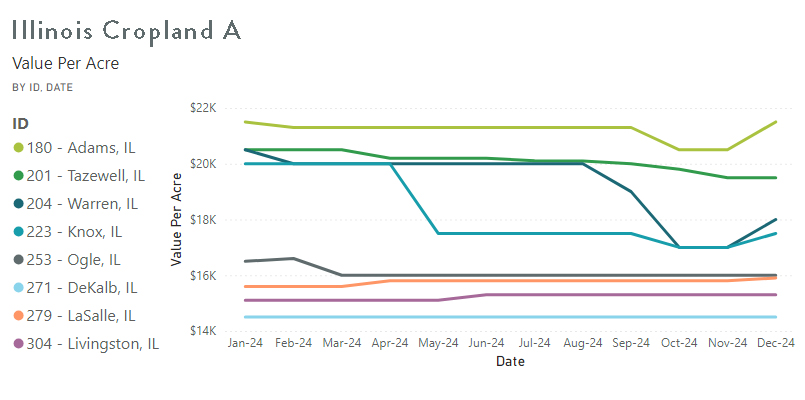

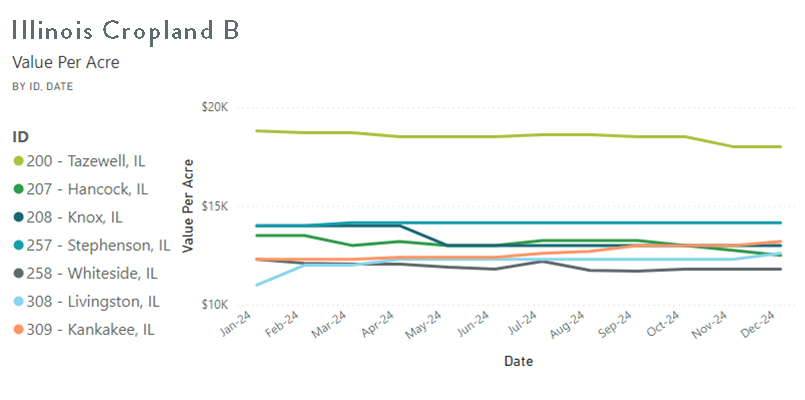

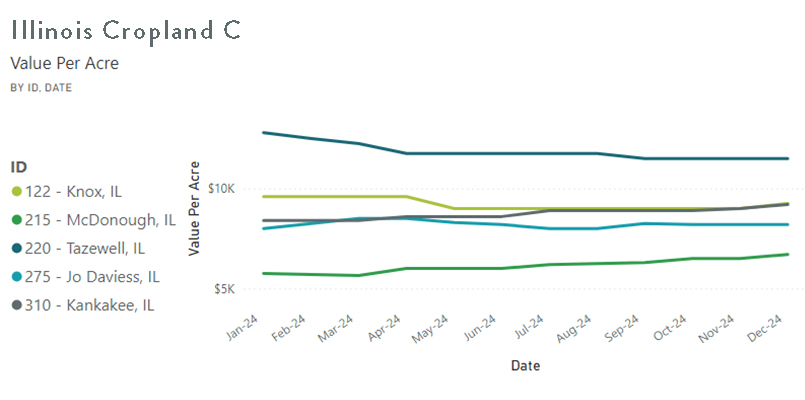

Illinois

Cropland A Farms experienced the strongest downward pressures over the course of the year resulting in some markets experiencing a 5-10% decline, as seen in chart 1. In contrast, Cropland B and C Farms exhibited more stability, with trendlines indicating smaller movements of 0-5%, demonstrated in charts 2 and 3. Sales volumes remained steady over the year, with most transactions occurring through auctions or broker listings. Overall, the conclusion can be made that the upper end of the market is softening.

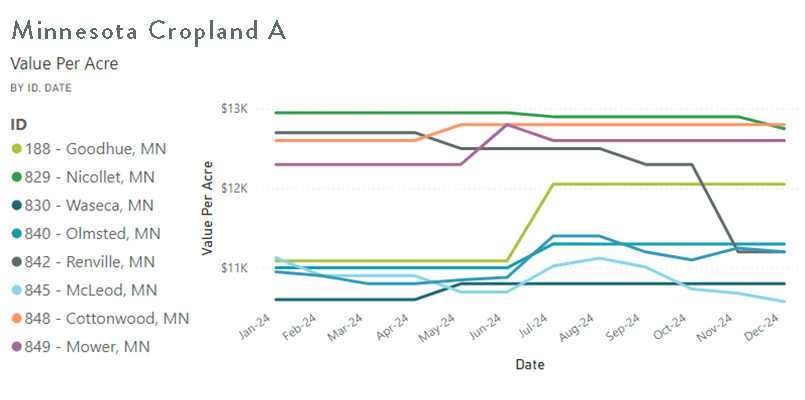

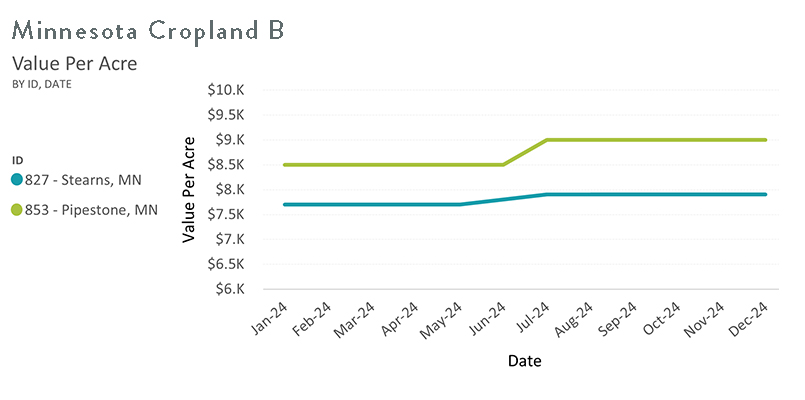

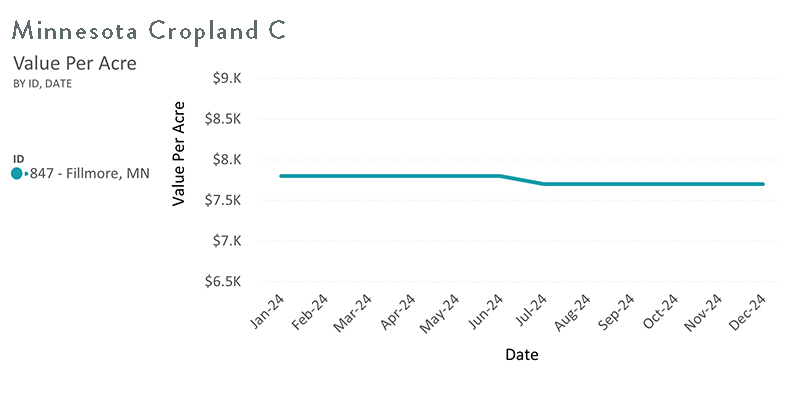

Minnesota

Despite poor weather conditions throughout the growing season and softening commodity prices, land values in southern Minnesota again made modest gains . As displayed in charts 4-6 below, the benchmarks show many counties experienced year-over-year increases between 5% and 10%. One significant change in the market is the method by which farms are being sold. A handful of “no sales” at live auctions early in the year drove sellers away from this more traditional method of selling farmland and resulted in a large number of sales occurring through a formal listing process or private negotiation. These provided sellers with a good hedge against a market that had priced some potential buyers out due to higher interest and inflation.

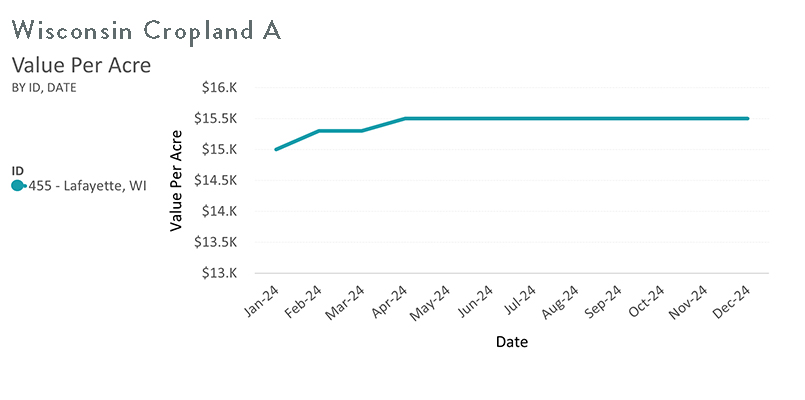

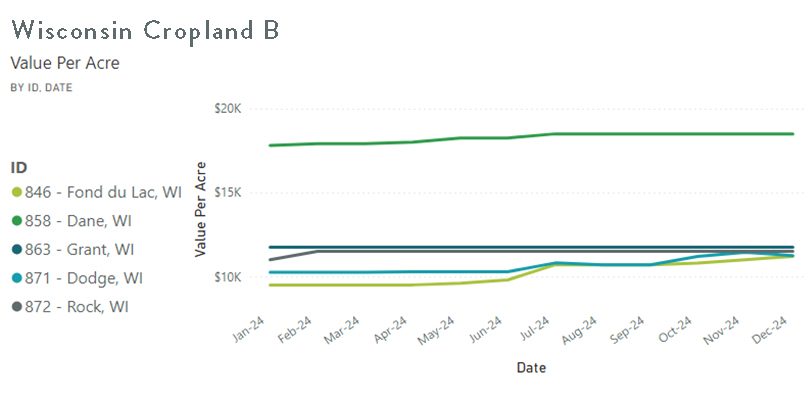

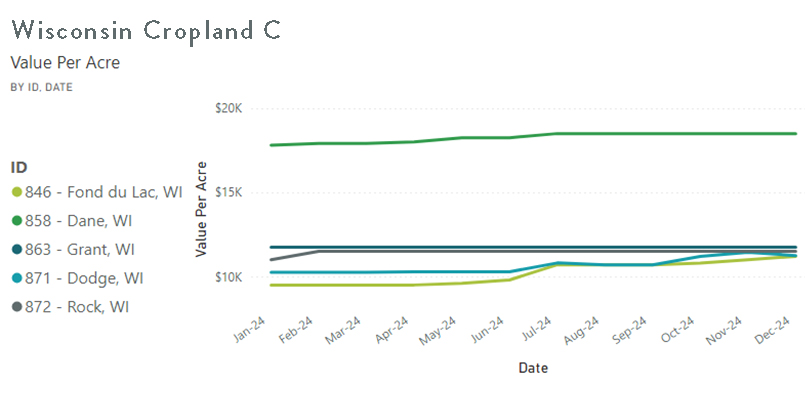

Wisconsin

Overall, the cropland benchmark farms in Wisconsin showed a stable to increase in land values throughout 2024, as shown in charts 7-9. For the market areas that increased in value, the percentage ranged from 3-18%. The three benchmarks in the east central region of Wisconsin (benchmarks 846 – Fond du Lac, 871 – Dodge and 450 – Calumet) continue to show a strong trend of increased cropland values. This area is heavily populated with dairy farms, which have been the main buyers of land in this particular market.

Market Movers – Projections for 2025

Commodity Prices

Another challenging year appears imminent. The key question is not when prices will trend upward, but how to navigate another year of tight margins effectively.

Gary Schnitkey, professor at the University of Illinois, states in his podcast “Corn and Soybeans Economics in 2024 and 2025: Back to the New (Old) Normal?”:

“We just have to make our minds up that $4 corn is here for a while, so make our plans accordingly and move forward”.

The December USDA WASDE Report reinforces this outlook, projecting above-trend 2024 corn yields in Iowa, Illinois, Indiana and Nebraska. Combined with robust production expectations from South America, these forecasts point to an abundant global grain supply. The resulting supply pressures are likely to weigh further on prices, challenging farmers to prioritize effective risk management strategies in the year ahead.

Interest Rates

At the December 2024 Federal Open Market Committee meeting, the Federal Reserve lowered interest rates by 25 basis points, marking the third consecutive rate cut. This followed a 25-basis-point reduction in November and a more significant 50-basis-point reduction in September. However, the Fed’s forecast for 2025 cuts has been adjusted from the originally four to two projected 25-basis-point reductions. Chairman Powell emphasized that the Fed is prepared to pivot in any direction, signaling a cautious stance. With President Trump’s return to office, there is some uncertainty regarding his trade, taxation and immigration proposals. Chairman Powell noted that the Fed is “modeling and evaluating President Trump’s proposals but not yet incorporating them into decisions” because it is “unclear” what the policies will actually be.

The Fed continues to target a long-term inflation goal of 2%, with projections indicating inflation could reach 2.5% in 2025. Triggers for additional rate cuts in 2025 will be lower inflation, weakening in the labor market and slowed overall economic growth.

Land Values

If there were a single word to define the year for 2025 land values, it would be caution. Economic pressures are shaping more restrained markets, reflecting a cautious outlook. Farmer sentiment also reflects this cautious tone, with many expressing trepidation in purchasing land at high prices.

Instead, they are focusing on managing tight margins, conserving cash flow and preparing for potential headwinds. As a result, land markets are experiencing a more tempered pace, highlighting a collective pause to assess risks and opportunities carefully before moving forward.

As we move through 2025 and navigate a cautious real estate market, the need for precise and transparent valuation services has never been greater. Contact Agri-Access to connect with a trusted expert in farm and rural real estate valuation appraisal services.

Commentary and expertise provided by appraisers Carissa Schultz (certified appraiser in Wisconsin) and Aaron Stark (senior certified appraiser in Minnesota).